unlevered free cash flow margin

Free Cash Flow Margin. Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures.

Fcf Yield Unlevered Vs Levered Formula And Calculator

The formula to calculate unlevered free cash flow margin and an example calculation for Lockheed Martins trailing twelve months is outlined below.

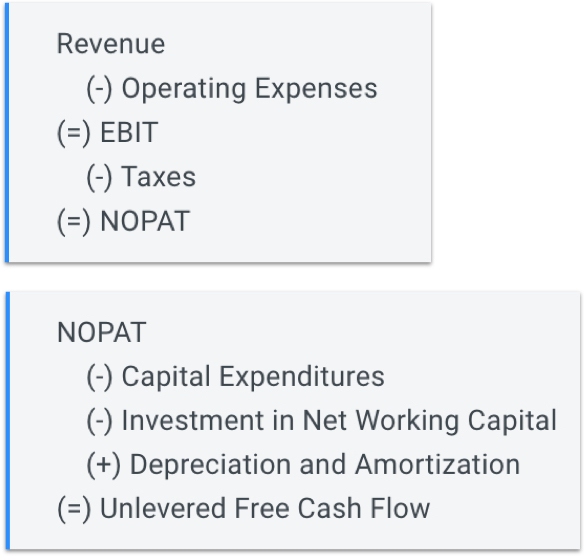

. Define Unlevered Free Cash Flow Margin. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes.

Internal Revenue Code that lowered taxes for many US. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. How Do You Calculate Unlevered Free Cash Flow.

Unlevered Free Cash Flow Margin. The formula to calculate unlevered free cash flow UFCF is as follows. Means total Unlevered Free Cash Flow for the current fiscal year minus the Board-approved pro forma Unlevered Free Cash Flow for Target for the.

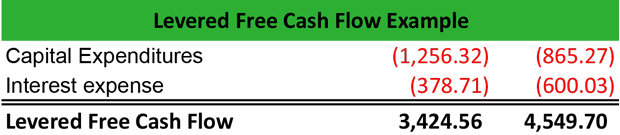

A complex provision defined in section 954c6 of the US. Levered free cash flow is the amount of cash that a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments. Non-GAAP Gross Margin Non-GAAP Operating Income and Non-GAAP Operating Margin.

Based on an estimated margin for that business was 70 and a flow through the cash of another estimated 70 that business alone will generate over 05 billion of unlevered. Unlevered Free Cash Flow EBITDA CAPEX Working Capital Taxes. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

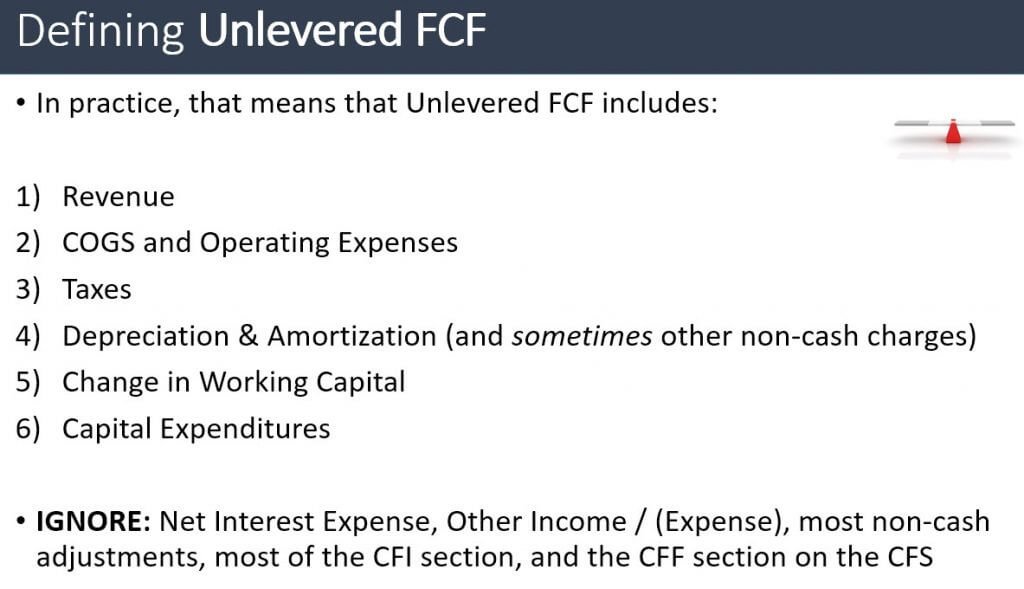

Open an IBKR account with no added spreads markups account minimum or inactivity fee. Unlevered Cash Flow is calculated using the following formula. Unlevered free cash flow is defined by how much money is brought in by a company before accounting for interest payments.

This metric is most useful when used as part of the discounted cash flow. So these are the. View NASDAQGSFBs Unlevered Free Cash Flow Margin trends charts and more.

How to Calculate Unlevered Free Cash Flow. Putting Together the Full Projections. The formula to calculate the unlevered free cash flow for a company is the following.

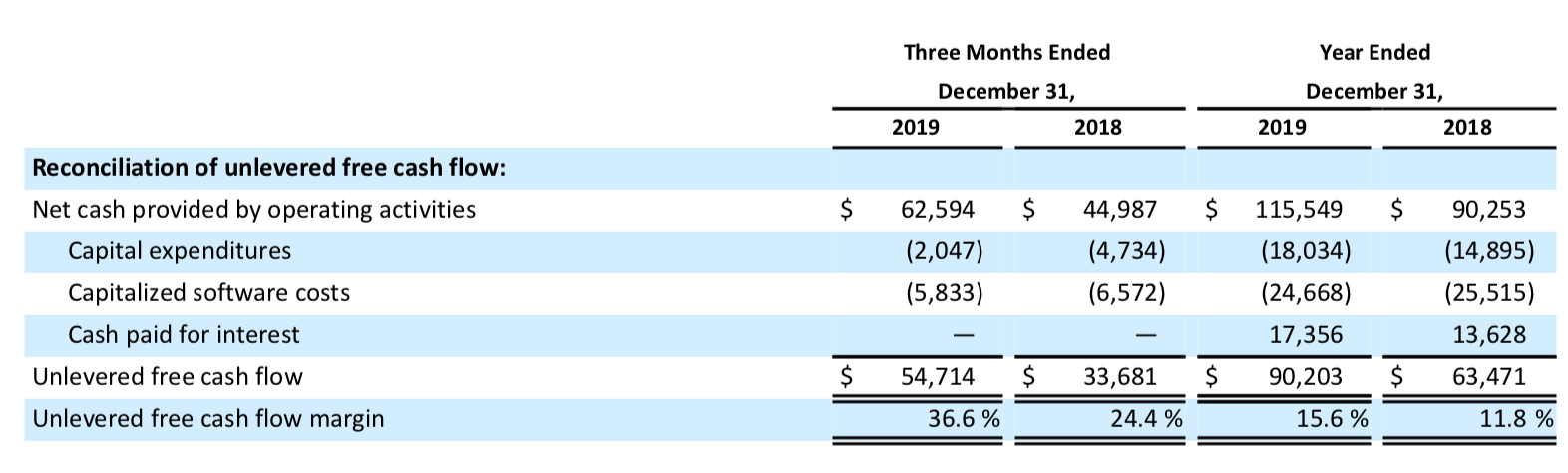

Margin tells us what portion of sales ends up as. Unlevered Free Cash Flow. Unlevered free cash flow is a measure of our liquidity.

UFCF EBITDA - CAPEX - Working Capital - Taxes. Unlevered Free Cash Flow Formula. Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator.

Six bolt-on and two in. FCFF EBIT 1-t Depreciation. The look thru rule.

Therefore youll find that unlevered free cash flow is higher than levered free cash flow. Open an IBKR account with no added spreads markups account minimum or inactivity fee. The formula that is used in order to calculate.

8 hours agoAdjusted EBITDA of 357 million very high margin at 336 Unlevered free cash flow of 155 million Eight acquisitions completed year-to-date in six countries. 10 hours agoBased on an estimated margin for that business was 70 and a flow through to cash of another estimated 70 that business alone will generate over 05 billion of unlevered. Meta Platformss latest twelve months unlevered free cash flow margin is 241.

Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. It shows how much cash is available to the. Levered free cash flow assumes the business has debts and uses borrowed capital.

Unlevered Free Cash Flow Operating Income 1 Tax Rate Depreciation Amortization - Deferred Income Taxes - Change in Working Capital Capital Expenditures Why do we ignore. As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less.

Discounted Cash Flow Analysis Street Of Walls

What Is Levered Free Cash Flow Definition Meaning Example

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Definition Examples Formula

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cornerstone Ondemand It S Now About The Cash Flow Nasdaq Csod Seeking Alpha

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Formula Calculator Excel Template

Understanding Levered Vs Unlevered Free Cash Flow

Discounted Cash Flow Analysis Street Of Walls

What A Excessive Weighted Common Value Of Capital Signifies India Dictionary

Free Cash Flow To Firm Fcff Formulas Definition Example